This is a sponsored article by IDTechEx

People often talk about the killer application for graphene. Has one yet been found?

A killer application is one that has a large market and is uniquely enabled by that technology. Some technologies can become commercially successful over time without requiring a so-called killer application - and I believe this is the case for graphene.

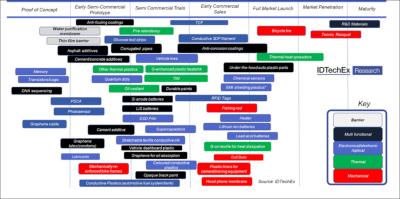

In fact, one point of strength for graphene is that it has such a diverse and deep application pipeline. The image below demonstrates this. The image shows that (a) some applications beyond R&D are already in the early phases of commercialization, (b) that many other applications are close to commercialization, and (c) that the application pipeline is deep. Of course, graphene cannot be expected to succeed in all of these applications, but equally it is unlikely to fail in all. As such, this diversity will give, on the aggregate, a strong long-term resilience to the market.

Source: IDTechEx Research Report Graphene, 2D Materials and Carbon Nanotubes: Markets, Technologies and Opportunities 2019-2029 (www.IDTechEx.com/Graphene)

So, are there successful applications of graphene already?

Yes- some applications beyond R&D use have already been commercialized. Indeed, our Graphene & 2D Materials (www.GrapheneUSA.tech) event in California is a very strong reflection of this trend towards commercialization of graphene.

Graphene in automotive has been an interesting story. Last year at our event we heard from XG Sciences, who discussed the use of graphene in vehicle under-the-hood applications for customers such as Ford. At this year’s event, which will take place on November 20-21, 2019 in the Silicon Valley California (Santa Clara), you will hear from Martinrea, a $4Bn major autoparts manufacturer, together with NanoXplore, a graphene company with ambitious scale-up and pricing plans.

An interesting related area is in the use of graphene in polyurethanes. This has already been commercialized. Last year you heard from First Graphene Ltd on how graphene was used in polyurethane wear lines. This year you will hear from Grafine, who will show how graphene can add value in polyurethane sports shoes and how it is already commercialized. Of course, graphene can be added to many other materials to form advance composites. For example, this year you will hear from Qenos Pty Ltd, a major Australian polyethylene producer, about how graphene can add value as additive to this polyethylene.

Energy storage has seen important commercial developments. Indeed, we understand that graphene has been deployed in the battery of some electric vehicles in China. Therefore, as with every year, we are putting a heavy emphasis on this topic in our event too.

This year you will hear from Global Graphene Group, a major pioneering graphene company. They have also developed graphene-Si composites, and will this year discuss their journey towards graphene-enabled electric vehicle batteries. We will also hear from JMC: a major Korea producer with long-standing expertise in the production of sulfur-based fine chemicals. JMC will also discuss their work towards bringing graphene oxide into energy storage devices.

The event will also include NanoGraf, a developer of graphene-Si energy storage and a company which recently received funds from JNC Corp in Japan. Silicon anode, as you know, can potentially dramatically increase the energy density, but suffers from a very limited cycle life due to the physical expansion of silicon particles. Graphene-Si anode composites however can offer a good balance between energy density and lifecycle. William Blythe, an old British fine-chemical manufacturer, will also discuss their work in graphene in li-ion anodes. Finally, we will hear from Graphene Batteries on their progress towards Li-sulphur batteries.

Another key application is the use of graphene in thermal management. This year at our Berlin event we heard how Sixth Element was using its rGO to develop heat spreaders for mobile phones and how this was already a 150-200tpa order. In the upcoming US event, we have invited NeoGraf Solutions, a renowned US company active in flexible graphite thermal management solutions. In this talk we will hear how graphite and graphene actually compare in terms of thermal management properties. This is an important discussion, as in many graphene events many pretend that graphene exists in a competitive vacuum!

In general, we think graphene commercialization is approaching its tipping point where the market volumes will take off. There is extensive experience in the industry both on the supplier as well as the end user side. The prices have come down and the production capacity now exists. Crucially, the industry has spent years trying to determine which graphene markets do, and which do not, make sense. This is no easy feat and has certainly taken collective industry time. In fact, the issue of end user views, and their perspective and experience, is critical. This is why in our event we have also invited the likes of Morgan Advanced Materials, a billion pound British material producer with expertise on advanced carbons and ceramics, to share their views on how graphene has been, and can be better, translated from the lab to the market.

Yes, but these are all relatively high-profile target markets. You mentioned that the application pipeline is robust. So, what are the other emerging target markets?

In terms of platelets there are of course many other applications beyond those mentioned above. Our event also reflects this strongly so please allow me to use this event as a way to highlight some key trends.

Graphene has been proposed for water filtration. Here, we hear from Standard Graphene and their recent results in this regard. Note that this Korean company has recently announced that they have installed a graphene-based water filtration installation in Nepal.

We will hear from University of Manchester, who will share their progress on the use of graphene in concrete. This is potentially a very high volume application, however the price pressure and capacity requirements are still tough, and graphene based results will need to be better benchmarked against competing materials.

We will hear from Quantag Nanotechnologies, a Turkish company that has developed a method to create stable solutions of graphene quantum dots for use as in-liquid security tags. Another start-up which is proposing the use of graphene as a quantum dot material is GOLeafe. They too will speak at our event. In general, quantum dots are a success story in displays, but those quantum dots are high quantum yield and narrowband emitter or downcoverters. Carbon based ones, however, have different attributes and will thus have different target markets.

We will hear from Imagine Intelligent Materials, an Australian company wishing to integrate graphene into technical textiles for smart surface sensing applications. We will hear from NTherma on their work to create stable graphene-in-oil suspensions and how these suspensions, based on their road test results, can reduce the coefficient of friction and improve fuel efficiency. And last but not least, Graphene Tech S.L. will share their progress on industrialization and also on applications of graphene in flexible and wearable applications.

So overall you can see there are many emerging applications of graphene beyond coatings, energy storage, composites and thermal management, and that our event strongly reflects this.

Many applications that you mention require high volume and secure suppliers at reasonable prices. So, can graphene actually be produced in large volumes today?

This is a great question. The industry has been faced with that classic chicken-and-egg dilemma. The end users will not advance discussions past demonstration performance in the absence of proved ability to securely and safely offer consistent supply, and the suppliers- often start-ups in this field- find it difficult to raise and invest capital faced with no confirmed orders and with speculative orders.

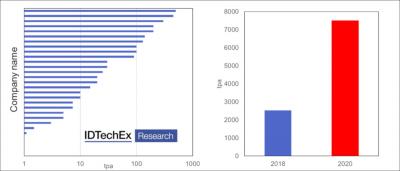

However, the industry has taken important steps to address this issue. Today, there is a capacity on the scale of several thousand tonnes. Again, I share the chart below to showcase this. Some players have multi-hundred capacity. Furthermore, part of the industry has renewed confidence in itself, and this is shown by the fact that many have announced very aggressive scale-up plans. I also share an image to show this. In this image your readers can see how the capacity will expand if all the announcements come through. It is not a prediction but an aggregation of what all the announcements, if they come true, would amount to. Interestingly, if these announcements do take place, the balance of production capacity will shift towards the rest of the world from China.

This is therefore an important point, and that is why our event also focuses on this. In California, you will hear from NanoXplore, a company having put in place one of the most ambitious capacity scale-up plans worldwide. Global Graphene Group will discuss their production processes, JMC will talk about their stable rGO capability, Abalonyx will talk about their scale-up plans for their well-controlled rGO process, and Talga Resources will give an update on their scale-up progress and also on their strategy towards creating an integrated production-to-product approach.

The story is not just about scale, though that is important. It is also about innovation in production. And here too there are many noteworthy innovations. For example, Texas A&M University has developed a method to overcome the disintegration of graphite electrode during the electrochemical process. Nano disintegration of the graphite electrode as the method progresses, or Nanotech Energy claims to have a top-down rGO process that allows exfoliation without any compromise in intrinsic graphene qualities.

Source: IDTechEx Research Report Graphene, 2D Materials and Carbon Nanotubes: Markets, Technologies and Opportunities 2019-2029 (www.IDTechEx.com/Graphene)

Earlier you mentioned that graphene does not sit in a competitive vacuum. So, what are the competing materials?

That really depends on the application, because the competing materials in each application are different. For example, graphene films might compete against ITO films or silver nanowires in a transparent conductive film application. However, in most cases, graphene competes with other forms of carbon materials such as graphite, black carbon, or carbon nanotubes. The benefits of graphene against alternatives in each case will need to be experimentally verified, and so far no universal generalized approach exists for determining, in advance and a priori, where graphene, or what graphene type, will win.

In fact, graphene itself is very diverse and many graphene types exist on the market, all different from the ideal time and some even forcefully arguing that some so-called graphenes are in fact thin graphite and are thus mis-sold. One company is however seeing it differently and wants to take advantage of the diversity of graphene to develop tailored graphene lines for each product. This company is Nova Graphene, and they too will speak at our upcoming event.

Our event Graphene & 2D Materials on November 20-21 in Santa Clara, CA also strongly focuses on this topic. Here, we hear from Cabot Corporation. Cabot is of course a major global black carbon supplier and has previously demonstrated promising work on graphene, especially in composites and energy storage applications. This year, they will however unveil a novel form of conductive nanocarbon material. As mentioned above already, NeoGraf will critically compare and contrast graphene vs graphite as a thermal material. And OCSiAl will also discuss how their single-walled carbon nanotubes, whose production they have scaled up and whose properties are akin to a rolled-up single-layer graphene, can deliver value in numerous applications as an additive.

The discussion so far has focused on graphene platelets or powders. What about the film type graphene? Any progress there?

Great question. The main focus has thus far been on graphene platelets, but that does not mean that CVD or wafer scale graphenes have been standing still. Indeed, some firms have already developed production techniques and facilities to produce CVD graphene in a roll-to-roll manner. One example is LG Electronics. At our upcoming event, Graphene & 2D Materials in in Santa Clara, CA on November 20-21, they will discuss their method and their progress towards increased web width and also overcoming some transfer-related challenges. Grolltex will discuss how they are taking steps to become a 2D material foundry. Their proposition is that they can R2R produce a variety of 2D materials- not just graphene- on flexible plastic substrates, thus enabling a set of applications.

Kukil Graphene and Chungam University will also make a promising announcement. They will discuss how graphene- directly synthesised on a PET thus no transfer step required- can be doped with nitrogen to act as the active channel of a thin film transistor device. This study hints at addressing two issues, namely, the transfer and the bandgap issues.

But not all CVD research is focused on production scale-up and related issues. Many are also developing and commercializing applications. Researchers from the US Naval Research Laboratory will also outline their progress in the use of 2D materials as highly sensitive layers which could provide a basis for electronic noses. Cardea will also discuss how they commercialized CVD graphene in a packaged electronic device for use a diagnostic test. This is an example of real commercialization.

One topic that is often neglected is the wafer scale integration of graphene and other 2D materials. This is an interesting area in which there has been significant progress in academia. Many approaches have been proposed to develop, in some case even single crystal, graphene on Si wafer. This is important because it brings both graphene -and other 2D materials- one step closer to being a material that can be integrated with silicon electronics, or one day become a wafer-based electronic or sensing platform. To capture this trend, we have invited Graphenea, a pioneering Spanish graphene company, to discuss the lab-to-fab transition of wafer-scale graphene.

And finally, significant funding has gone into the research community and many innovations, one way or another, stem from the research community. Can we also learn about the latest results at your business-focused graphene event?

Certainly. We fully recognize the importance of research. This is why this year we are holding a session in which key trends in the latest commercially-relevant academic research are summarized and discussed. This will allow our audience to get a grasp of the latest trends in a very time efficient manner and to assess how research of today can fuel the innovation or product pipelines of tomorrow.

To this end, we have invited Dr Felice from Imperial College London to outline the latest developments in the use of graphene and other 2D materials to print functional, complex, and flexible electronic devices such as transistors. This topic also fits very well with our co-located event on printed electronics. We have invited Dr Luigi Occhipin from the Cambridge Graphene Centre to discuss the latest trend on wafer-scale integration of graphene and other 2D materials for electronic and sensing applications. Dr Elena Polyakova, formerly a founder of Graphene 3D Lab and now with the National University of Singapore, is to offer a candidate and critical assessment of graphene and 2D material composites. And finally, we have Prof Kymakis, from Hellenic Mediterranean University, to outline the latest research trends and results in graphene energy devices.

You have mentioned the so-called tipping point in this discussion. What reasons do you have for thinking that such an inflection point is nearing and how do you see the current and future market trends?

Well, we assess that the graphene market has entered into a more interesting and dynamic phase. For the past several years, doubt had settled in, and the pressure was high given that few applications had transitioned to the market, even in small volumes, so people were asking: what happened to all that promise? Now that we can see some success stories even if they are small and may not all last there is renewed optimism. We think this behaviour is completely normal, and it is common for a new material to take time before it is commercialized.

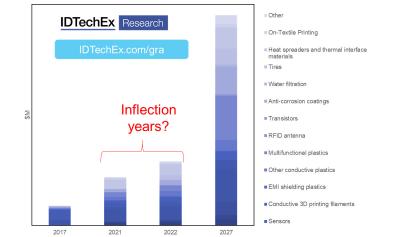

We also assess that we are likely approaching the tipping point for graphene. The inflection point is likely around 2021/2022. There are many reasons for this argument but some include the fact that products are being commercialized, revenues are going up even though most firms are still loss-making, production capacity exists and production parameters including consistency have improved, prices have become lower, and finally the suppliers and users have a more realistic and focused view of where graphene use could deliver value. This last point proper strategic market segmentation is very important and represents hard-won strategic asset and know-how for many firms. Overall, we think the industry has the potential to become a $300M market by 2028 or so.

The business landscape is being transformed. We think some consolidation will take place and indeed has already begun. Just look at the speaker list in our previous version of events; some of those firms have left the business and some are very almost worryingly quiet in the market. Some also have limited financial resources and/or no clear strategy for breaking out of their current predicaments and thus will likely struggle. Some firms, though, are pulling ahead of the rest and are showing signs of likely winners.

So, in general we think that the industry is re-entering a renewed phase of excitement. This is why this year we decided to further expand our graphene programme in the USA. By the way, I forgot to mention that our event is co-located with our other synergetic events including those on electric vehicles, energy storage, innovative sensors, wearable electronics, and printed or flexible electronics. Overall, we expect over 3500 attendees and 270 exhibitors. Please see www.IDTechEx.com/USA for further information.

IDTechEx guides your strategic business decisions through its Research, Consultancy and Events services, helping you profit from emerging technologies. Find out more at www.IDTechEx.com

Source: IDTechEx Research Report Graphene, 2D Materials and Carbon Nanotubes: Markets, Technologies and Opportunities 2019-2029 (www.IDTechEx.com/Graphene)