UK-based planarTECH has launched an equity crowdfunding campaign on Seedrs, as part of Graphene-Info's Graphene Crowdfunding Arena. planarTECH aims to expand its current business and also initiate new graphene endeavors. Investors are now able to participate in this financing round.

Here's our interview with planarTECH's co-founder and CEO, J. Patrick Frantz - who explains the company's technology, business and future plans.

Hello Patrick, thanks for your time! planarTECH has been supplying R&D graphene systems since 2014, with over 65 existing customers. Can you tell us a bit about these systems and how they are used today?

We have mainly been supplying small-scale Chemical Vapor Deposition (CVD) systems for the growth of graphene and more recently, other 2D materials such as hexagonal boron nitride (h-BN) and transition metal dichalcogenides like MoS2, WSe2, etc. These systems have been primarily used by academic, government and corporate researchers for the synthesis of new 2D materials and exploring the large variety of applications for these 2D materials. We’ve been successful in the sense that we’ve been able to place our systems into some of the premier institutions in this field, such as the University of Manchester, the University of Cambridge, Stanford University and the National University Singapore.

Researchers have a lot of interesting ideas, and our strength has been the ability to customize systems to the exact needs of researchers. We get a lot of repeat customers, such as the National University Singapore, the Institute for Materials Research and Engineering in Singapore, and the Cambridge Graphene Centre, which has 3 of our systems.

What are your views about the CVD graphene market? Will we finally see commercial adoption of these materials soon?

Yes, we do think the market is close to the tipping point of CVD graphene. We’ve seen a tremendous amount of industrial interest in CVD graphene over the past 1-2 years, and internally we’ve done the calculations that show investment in production can be profitable while also meeting the price expectation of customers. For example, we know now it is possible to get the production cost well below £0.25/cm2 (depending on the volume). This is far lower that existing products on the market.

planarTECH is aiming to grow its business by starting supply industrial-scale systems. What is the difference between industrial-scale and R&D-scale systems? Who do you target as customer for such systems?

Well, the main difference is the systems are simply much larger with more capacity to hold large sheets of copper/nickel foils/foams or discrete components. We have not been specifically targeting customers as such. We have a well-established brand in the market. People know we make systems, so they come to us to talk about production. One obstacle for the growth of CVD graphene has been the issue of transfer, which both we and customers are aware of. One things we have done is to try to identify applications that do not require transfer, and we are engaged with a number of customers now who fall into this category.

For application development and demonstration purposes, we have access to our largest system in the world, a planarGROW-8S at the National Electronics and Computer Technology Center in the Thailand Science Park, and we have used this as the basis for a design of a much larger system. This has certainly been useful in helping us to talk with industrial customers about large-scale production.

planarTECH is also entering the material market - and will produce its own materials. What is your edge compared to other CVD graphene material makers?

I wouldn’t say we are entering the material market. We definitely plan to stay on the system side, but we do work with customers on a case-by-case basis who want to coat their material/parts with graphene as part of the discussion around production. As part of our crowdfunding campaign with Seedrs, we do hope to raise the funds to buy our own production system, which would leave the door open for us to engage in toll processing for customers who may not yet be ready to invest in their own production equipment.

We understand that you are already in talks with several customers - in Germany and in Thailand for example. Can you tell us a bit more?

Yes, we’re currently working with customers in Thailand, Taiwan, and Germany who have given us their parts for coating trials. Unfortunately, we cannot disclose too much about the specific applications because in many cases we do not possess that info ourselves! I can say that one customer is asking us to coat discrete copper components and that another has developed some kind of sensor that uses graphene on copper. These are both applications that do not require transfer and sensors are definitely one application that we think has great potential for CVD graphene.

planarTECH has strong presence in Asia - how do you see the coronaVirus effecting business in Asia? Will it have a long lasting effect?

Our CEO is based in Thailand, which has a number of cases. We’re watching the situation carefully, but we view it much the same as SARS in that we think there will be a short-term (6-9 month impact) in the region where travel may be restricted, which could affect business development efforts. However, we do not currently foresee any immediate impact on our sales for 2020 or our pipeline of opportunities.

What is the current status of graphene adoption in Asia? How does it compare to the status in the EU?

We know of a number of Asian companies who have already launched graphene-based products. The difference between the West and Asia is that the Asian companies may simply get on with things and release products without much fanfare around graphene. So chances are they may not even talk about it. One thing we have also seen recently is a boom in the use of CNTs in secondary battery applications. One Korean maker we know has recently decided to double production from 300 tpa to 600 tpa. We expect graphene will follow into this and similar applications once the production cost can be brought down.

In the UK and Europe, we think adoption will be slower. The primary accessible industries are automotive and aerospace, both of which have extremely long product design cycles. Other applications may be realizable in the short-term, but chances are it will be Asian companies doing the production due to outsourcing.

An important area of growth for planarTECH is non-graphene 2D materials. Can you tell us more about your goals there?

Most of the academic researchers have moved on from graphene to other 2D materials, such as transition metal dichacogenides (TMDs), such as MoS2, which shows promise for both semiconductor and sensor use. We follow the researchers in this space, and the last three systems we shipped in 2019 were for TMDs and not graphene. One of the nice things about this business is that it does give us insight into the future possibilities for applications, and when we see something interesting then we can focus on it.

So on the commercial side, while we’re focused on graphene for now, we’re definitely keeping our eyes open on the possible commercial applications of these other emerging 2D materials, and we’re able to do that because of our customer base.

We understand that 2019 was a bit of a "down" year for planarTECH, can you tell us what are your plans for 2020?

Yes, we had an off year in 2020, which we attribute mainly to Brexit, as many projects in the UK and EU were postponed until there was some clarity on that topic. For 2020, we already have £295,000 of orders in hand with a very healthy pipeline of projects that we expect to realize in 2020. We expect the system business to be back above £1m in turnover for this year.

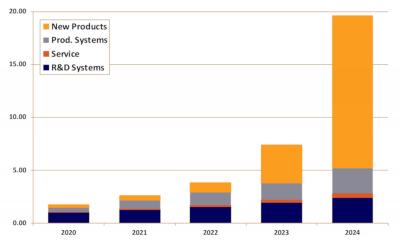

What is your financial goals for 2020-2024 following a successful funding round?

We will continue to sell R&D systems, which has been good business. We expect to grow that by 25% per year. With 65 systems now in the field, service and support has become an issue, so one thing we plan to do is hire dedicated staff for this, which will free up the time of our existing sales staff who can then work to bring in new R&D system projects.

One of the things we will do with the funds raised will also be to acquire our own production system for in-house use. These we will use as a demo system for industrial customer and also as a system we can use for actual production on a toll-processing basis. We’re already in talks with several customer about production and aim to sell our first production system in late 2020 or early 2021.

Many investors are wary of investing in graphene technologies following the dismal performance of most public graphene companies.What sets planarTECH apart from the current public and private graphene companies?

Yes, we definitely observed the hype and disillusionment cycle first hand, but we now think that graphene has entered the recovery phase as we’re starting to see real products being launched that use the material in a meaningful way.

One of the things that sets planarTECH apart from other companies is that we have had actual consistent sales with cumulative revenues exceeding £5m and average annual turnover of £1m for the past 5 years.

In addition, we are in a unique position in that on one (academic) side we’ve developed a really strong network that gives us unparalleled insight into the pipeline of applications for graphene and other 2D materials. And on the commercial side, both I and and our CEO, Patrick Frantz - via our experience at Haydale - have excellent and direct connections to the real-world supply chain, especially in Asia.

Thank you Patrick, and good luck to you and to planarTECH!

planarTECH is the first company to apply to our Graphene Crowdfunding Arena, and potential investors can currently pre-register for exclusive early access to this campaign. The first step should be to join Seedrs as an investor (which will also enable the participation in future graphene campaigns) and then to apply to planarTECH’s investment page as an interested investor. The company's campaign will go live soon!