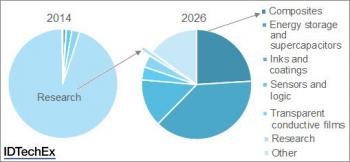

A few weeks ago we reported on a new IDTechEx market report, in which they predict that the graphene market will reach nearly $200 million by 2026, with the estimation that the largest sectors will be composites, energy applications and graphene coatings.

A few weeks ago we reported on a new IDTechEx market report, in which they predict that the graphene market will reach nearly $200 million by 2026, with the estimation that the largest sectors will be composites, energy applications and graphene coatings.

We were very interested in learning more, and Dr Khasha Ghaffarzadeh, IDTechEx's head of consulting was kind enough to answer a few questions and explain the company's view on the graphene market.

Q: IDTechEx has been following graphene for a long time with dedicated events and reports. Why is this new material interesting for IDTechEx?

We have a long track record of analyzing emerging advanced materials such as quantum dots, CNTs, Ag nanostructures, silicon nanostructures, OLED materials, etc. We were however pulled into the world of graphene by our clients’ questions. Once in, we soon realized that there is a big synergy between graphene and our events. in fact, our events on supercapacitors and printed electronics were the right near-term addressable market for graphene, and that is why we managed to rapidly build up the largest business-focused event on graphene. Our events on graphene are held in the USA and Europe each year see www.IDTechEx.com/usa.

Q: You recently released a new report, in which you predict that the graphene material market will reach only $200 million by 2026. Can you explain your findings?

The market is currently driven by sales of small samples for R&D and testing purposes. Companies are however building up strong sales pipelines. Beyond R&D, we think that conductive and thermal graphene coatings from graphene inks will be the first market. Technically they are the lowest hanging fruit and a range of interesting promising near-term applications have already been identified in heating, optically clear films, thermal interface materials, etc. This however will not be the biggest market for long.

The next wave of commercialization will come in energy storage and composite sector. In the latter sector, CNTs continue to make progress in conductive plastics thanks to their aspect ratio, while graphene will find its place in thermal or permeation-enhanced composites.

Q: This report is actually less optimistic than your similar report last year. What led you to lower your graphene market forecasts?

The report is not less optimistic about volume sales overall but our latest assessment show that prices are falling faster than we previously anticipated. Suppliers are desperate to make deals happen, and the price pressures are severe and long term. This is mainly because the main go-to-market is substituting an incumbent such as black carbon or even carbon nanotubes, the selling prices for which have fallen to 50 $/Kg.

Having said this it is important to note that there is a wide range of prices on the market today. This partly reflects the fact that there are many different types of graphene quality on the market, but the lowest cost is not necessarily the worse quality.

Q: Graphene is also trying to enter the energy markets. What are your views of that market and graphene's role in it?

We think that graphene will be an additive. Results already show that graphene can reduce the electrode resistance in Li ion batteries, leading to less performance deterioration at high discharge rates compared to conductive carbon. The price however persists as a concern for end users

Graphene can also be used in advanced or even post lithium ion energy storage devices. For example, in silicon anode batteries it can be used in carbon-graphene-nanosilicon composite electrodes. Its role is to extend the battery lifetime by absorbing the mechanical volume changes experience by silicon.

Graphene can also be used in Li sulfur batteries where it can help entrap LiS intermediaries during the charge up-discharge process, thus extending the life. Here however we think that graphene oxide will stand a better chance thanks to a better adhesion of sulfur particles on it.

Supercapacitors are also full of promise thanks to the surface area of graphene. The results are good for specific capacitance, but graphene occupies too much volume thus adversely affecting energy density. We know many leading supercapacitor makers have already tried graphene. Flat few-layered graphene is hard to use because of re-stacking issues, and thus we think that crumbled or curved graphene stands a better chance here. Here too, end users are concerned about production cost particularly given that activated carbon is now very cost effective.

It might be worth noting here that CNT also had success in the energy storage sector.

Q: Companies and governments all over the world are investing billions into graphene. If your forecasts are true, this may prove to be a large financial mistakes. Thoughts?

This will be a large financial mistake only if governments take a short term view of return on their investment. Graphene however should be viewed as a long term prospect, a technology with great potential but also with many challenges to overcome, which is great for research. Governments are already taking the long-term view and that is reflected in the time-scale scale of their funding commitments.

Note also that our forecasts are for many known applications of graphene but in the long term we will need an ‘other’ category for applications that are still unforeseen. This is because graphene has many fantastic properties, and not all of its application possibilities have yet been explored. It is therefore probable that a killer application will eventually be found. One reason to worry though is that CNTs have not yet found their killer application yet after many years of searching!

Q: Currently graphene is only commercially produced in flake/powder/ink format. When do you see larger high-quality graphene sheets being used commercially?

Graphene sheets are in a difficult market position. They were positioned as an alternative to ITO (the incumbent transparent conductive film technology), but they win neither on performance nor on price. The only chance that they have is to improve roll-to-roll CVD process to a point that transferred CVD graphene sheets on a PET substrate can be sold for around 10 $/sqm. That price will be difficult to match by competing technologies even in the long term. That is a big ask however given the complexities involved and it is never wise to bet just on being cheaper than the guy next door, particular in such a touch and consolidating market as the TCT market.

CVD graphene sheets are therefore a very long term development at best. They need substantial innovation or else there won’t be much of a market today beyond sales of small-sized CVD equipment

Q: Do you see graphene as a possible candidate for future chip material?

Graphene has no bandgap therefore it is a poor material for digital applications. It also has many intrinsic un-ideal behaviors even when used in analogue devices. We therefore don’t think that it has a future as a semiconductor for chip materials despite all the research and all the novel transistor architectures being explored. The research community has already recognized this limitation and moved on to other 2D materials that offer a bandgap.

Q: One area that interests us mostly is the display market. How do you see graphene's impact in this market as a possible electrode and backplane material?

We do not see graphene as a winning transparent conducting film, even when a high degree of flexibility is required. We also don’t see it as a transistor material for the backplane. The display market therefore does not seem the right addressable market for graphene flakes or films.

One thing's for certain - the graphene market is going to be very interesting.

Thank you Dr. Ghaffarzadeh!